How to Buy a Used Car in Texas: Complete Buyer’s Guide?

Buying a used car in Texas isn’t just about kicking tires and shaking hands. It’s a specific legal process with its own set of forms, taxes, and potential pitfalls. If you go in blind, you risk overpaying on taxes, getting stuck with a lemon, or worse—buying a car you can’t legally register.

You need a strategy. Whether you are hunting for a bargain on Craigslist or walking onto a dealership lot in Houston, the rules change depending on who you buy from.

Here is the deal: We are going to break down exactly how to buy a used car in Texas, from the initial search to the moment you walk out of the Tax Assessor-Collector’s office with your plates. No fluff, just the steps you need to take to drive away legally and securely.

Step 1: Know the Real Cost

Before you even look at a listing, you need to understand the “out-the-door” price. In Texas, the sticker price is just the beginning.

The 6.25% Sales Tax Reality

Texas charges a 6.25% motor vehicle sales tax. There is no way around this, but how it is calculated depends on who you buy from:

- Dealerships: They calculate 6.25% based on the sales price. They collect it from you and pay the state. Simple.

- Private Sellers: This is where it gets tricky. You pay the tax when you register the car, not when you hand over the cash. Texas uses something called Standard Presumptive Value (SPV).

- If you buy a car for $5,000, but the state says it’s worth $8,000, you pay tax on the $8,000.

- The state taxes you on whichever is higher: the sales price or 80% of the SPV.

- Tip: Check the SPV calculator on the TxDMV website before you agree to a price so you aren’t shocked at the tax office.

Registration and Title Fees

Budget for these additional non-negotiable costs:

- Title Application Fee: Around $28–$33 (varies slightly by county).

- Registration Fee: Base fee is $50.75 for cars and light trucks.

- Local Fees: Counties can add up to $31.50 in local fees.

- Inspection Fee: Roughly $7 (safety only) to $25.50 (safety + emissions), paid at the inspection station.

Step 2: Private Seller vs. Dealership

You have two paths. Each has different paperwork and risk levels.

Buying from a Dealership

This is the path of least resistance.

- Pros: They handle all the paperwork (title transfer, registration, tax). They are legally required to disclose certain defects.

- Cons: Higher prices. Dealer documentation fees (often $150+).

- The Process: You sign the contract, pay, and they give you temporary paper plates (tags). Your metal plates arrive in the mail a few weeks later.

Buying from a Private Seller

This is where the deals are, but you have to be your own project manager.

- Pros: Lower prices. No dealer fees. easier negotiation.

- Cons: Zero warranty. You handle all DMV paperwork—high scam risk.

- The “Blue Title” Rule: In Texas, a clear original title is blue. If the seller hands you a purple or brown title, that is a “Salvage” or “Rebuilt” Title. Unless you are a mechanic looking for a project, walk away.

- The Debt Trap: Always ask to see the Title up front. If a bank is listed as a lienholder, the seller cannot legally sell the car to you until that loan is paid off and the lien is released.

Step 3: Inspecting the Vehicle

Never trust the seller’s word. In Texas, “as-is” means exactly that. Once you buy it, every problem is your problem.

Get the Vehicle History Report

Before you drive to see the car, get the VIN (Vehicle Identification Number). Run a report through Carfax or AutoCheck.

- Look for: Flood damage (common in Gulf Coast cars), odometer rollbacks, and title washing (where a salvaged car is moved to a new state to clear its history).

- Red Flag: If the car has spent its life in a snowy state, check for rust. Texas cars are usually rust-free; imports from the north are not.

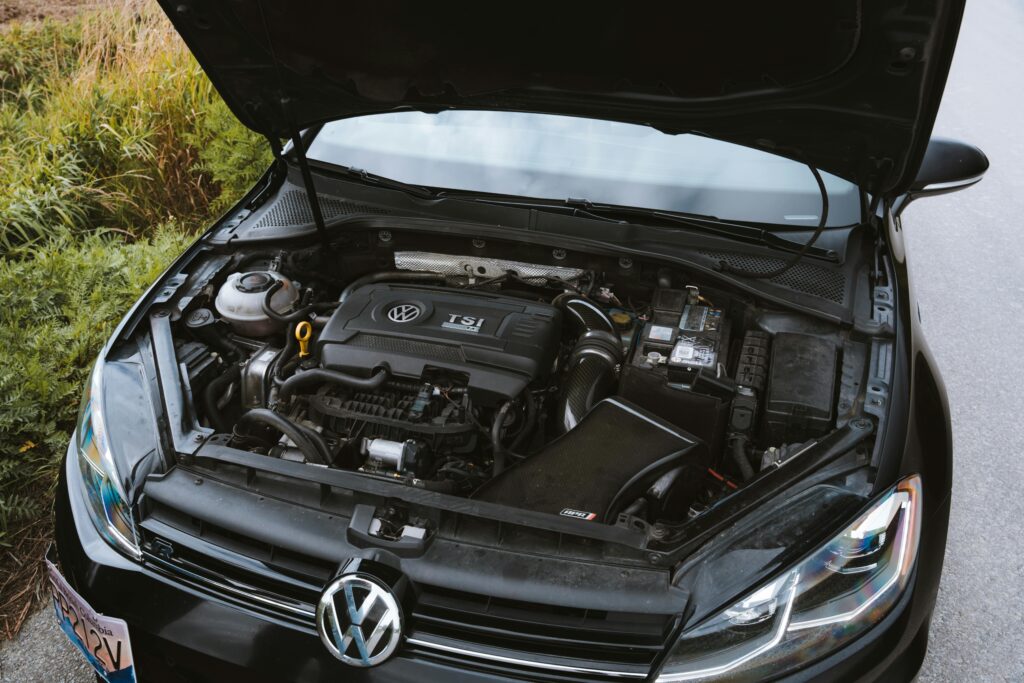

The Pre-Purchase Inspection (PPI)

This is the single most valuable step you can take. Take the car to an independent mechanic—not one the seller recommends.

- Cost: $100–$200.

- Value: They put it on a lift. They check for frame damage, leaks, and reset check-engine lights.

- Leverage: If the mechanic finds a $500 issue, you just found a reason to lower the asking price by $500.

Step 4: The Paperwork (Crucial Steps)

If you mess this up, you own a car you can’t drive. Here is the exact paperwork checklist for a Texas private sale.

1. The Title (Form 130-U)

The seller must sign the back of the Title. However, the Title alone is not enough to transfer ownership in Texas. You also need Form 130-U (Application for Texas Title and/or Registration).

- Both you and the seller must sign this form.

- It lists the sales price (used for tax purposes).

- Download this from the TxDMV website and bring it with you. Do not rely on the seller to have it.

2. Odometer Disclosure

For cars under 20 years old, the seller must write the exact mileage on the title assignment section. Ensure this matches the dashboard.

3. Vehicle Transfer Notification (VTR-346)

This protects the seller, but it’s good for you to know about it. The seller should submit this to TxDMV immediately to say “I don’t own this anymore.” If they don’t, and you run a toll, they get the bill.

4. Proof of Insurance

You cannot title or register the car without valid Texas liability insurance in your name.

Step 5: Avoiding Scams and “Lemon” Traps

Texas law is tough, but it mostly protects people buying new cars.

Does Texas Lemon Law Apply to Used Cars?

Generally, no.

- Exception: If the used car is still covered by the manufacturer’s original warranty (not a dealer extended warranty), you might have a claim if defects persist.

- Reality: Most used car sales are “As-Is.” If the transmission blows up 5 miles down the road, you own a broken car. This is why the PPI (Step 3) is non-negotiable.

Title Washing

Scammers take a flood-damaged car from Houston, register it in a state with lax laws, and then bring it back to Texas with a “clean” title.

- Defense: Look at the Vehicle History Report. If the car moved out of state immediately after a major hurricane, run away.

Curbstoning

This is when a dealer poses as a private seller to avoid laws and dump bad cars.

- The Tell: If you call and say, “I’m calling about the car,” and they ask, “Which one?”, they are a dealer illegally selling on the side. Genuine private sellers usually only sell one car at a time.

Step 6: Finalizing the Deal and Registration

You handed over the cash. You have the signed Title and the signed Form 130-U. Now you need to make it legal.

1. Get a Vehicle Inspection Report (VIR)

Before you can transfer the Title, the car must pass a Texas state inspection.

- Take the car to any certified inspection station.

- If you live in emission counties (like Harris, Dallas, Tarrant, Travis), you need the emissions test too.

- Keep the report (VIR). You need it for the tax office.

2. Visit the County Tax Assessor-Collector

You have 30 days from the date of sale to transfer the Title. If you wait longer, Texas hits you with penalties ($25 per month).

Bring these to the office:

- The original Title (signed by the seller).

- Form 130-U (signed by both).

- Proof of Insurance.

- Your ID.

- Vehicle Inspection Report (VIR).

- Cash, check, or card for taxes and fees.

Once the clerk processes your paperwork, you will pay your 6.25% sales tax and fees. They will hand you new license plates and a registration sticker. The new Title will be mailed to you in a few weeks.

Don’t Skip Steps

Buying a used car in Texas is a great way to save money, but the system punishes the unprepared. The state is strict about titles, taxes, and inspections.

Recap Checklist:

- Check the SPV so you know the tax bill.

- Get a PPI so you don’t buy a wreck.

- Bring Form 130-U to the sale.

- Inspect the car before you try to register it.

- Transfer the Title within 30 days.

If a seller refuses to let you inspect the car or “forgot” the Title, walk away. There are thousands of cars in Texas. Don’t settle for the one that gives you a headache.